- Lançamento original

- Episódio anterior S01E678 - The only wild monkeys in Europe

- Número S01E679

-

Links externos

Página de YouTube

-

Última atualização

25 juillet 2023 - 17:33

em 11 bancos de dados -

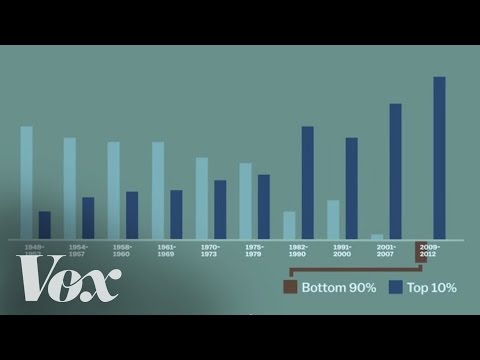

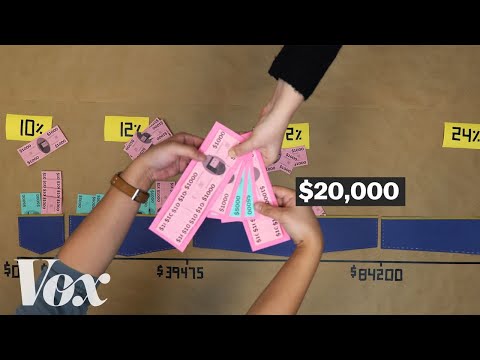

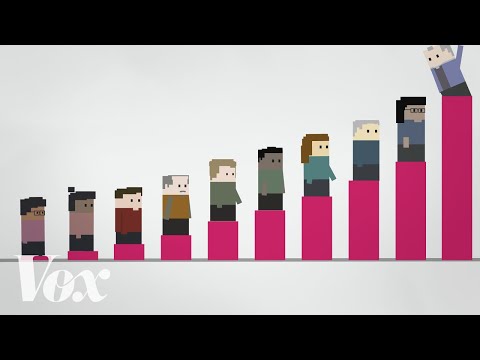

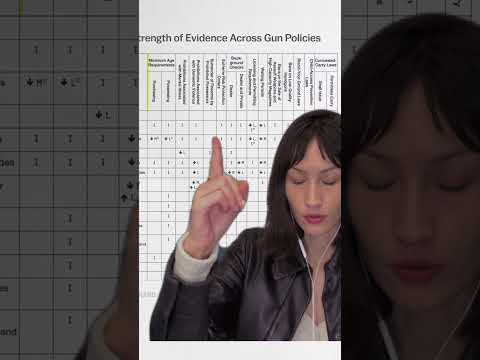

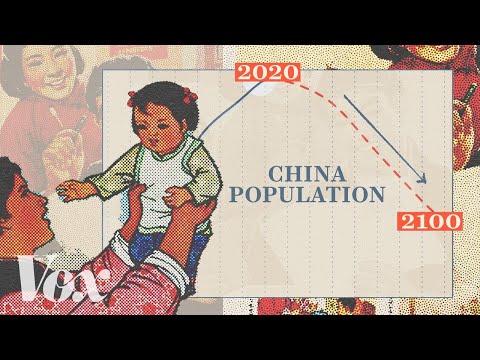

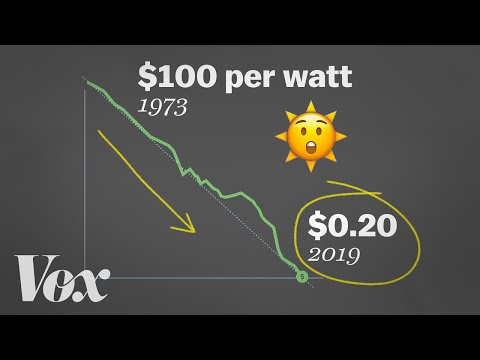

How tax breaks help the rich

The US has a problem with income inequality. The current tax code makes it worse.

Correction: At 2:20, we say that the Glenstone Museum is only open for private tours. But, in fact, it’s free and open to the public for scheduled tours.

Subscribe to our channel! http://goo.gl/0bsAjO

Check out our full video catalog: http://goo.gl/IZONyE

Follow Vox on Twitter: http://goo.gl/XFrZ5H

Or on Facebook: http://goo.gl/U2g06o

Vox.com is a news website that helps you cut through the noise and understand what's really driving the events in the headlines. Check out http://www.vox.com to get up to speed on everything from Kurdistan to the Kim Kardashian app.

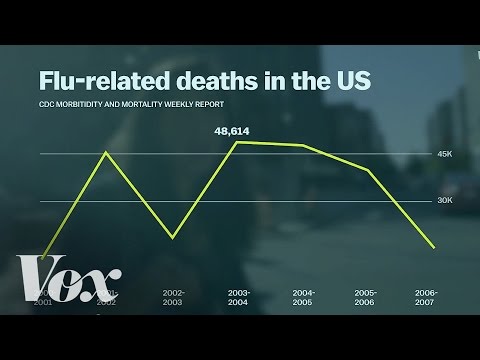

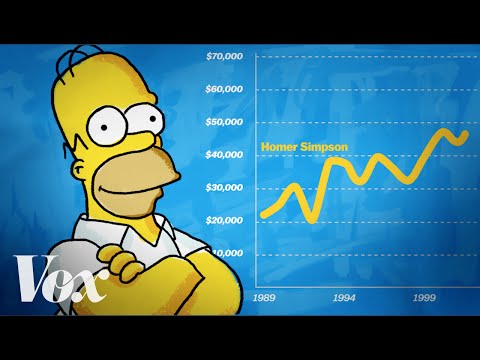

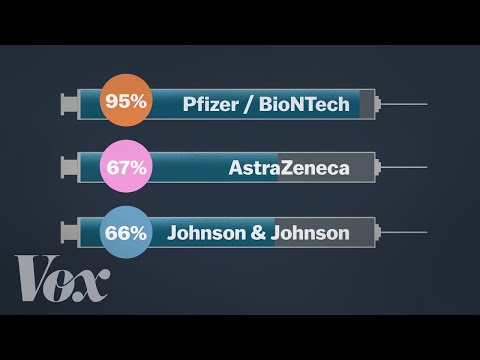

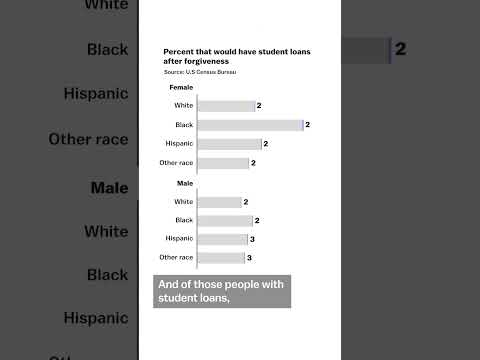

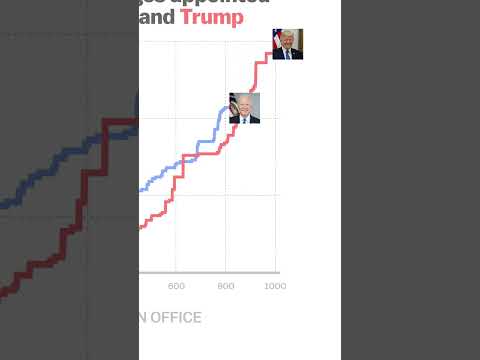

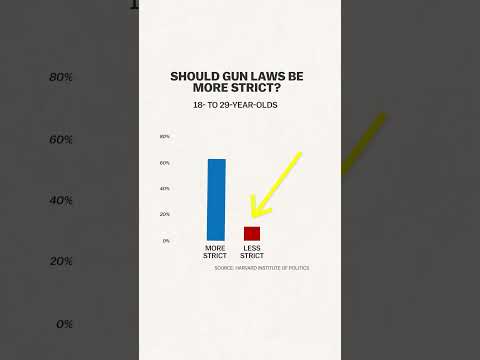

The gap between the rich and the poor in America looks more like developing countries than other Western nations. Trump and the GOP have proposed tax plans that will give massive tax breaks to the wealthy while it remains unclear if the middle class will get a tax benefit.

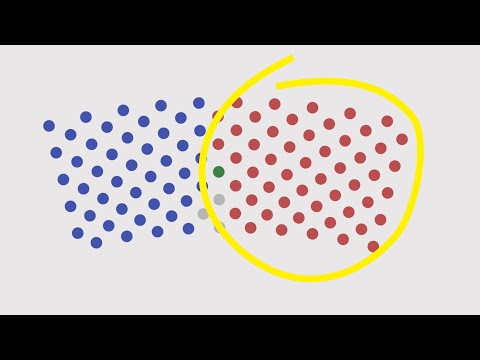

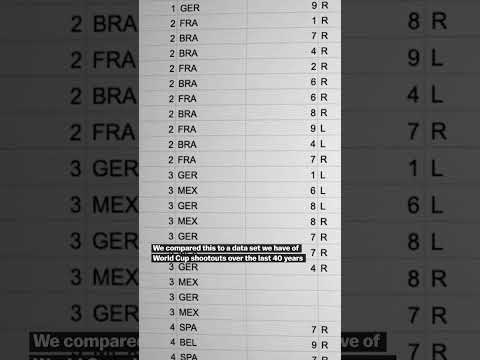

Deductions give a greater proportion of tax breaks to people with higher incomes. The same charitable contribution from two different incomes will benefit the higher wage earner, because deductions give tax breaks in proportion with tax brackets. Other countries have eliminated certain tax deductions in favor of tax credits. Credits give breaks in proportion to the amount you give, not the amount you owe.

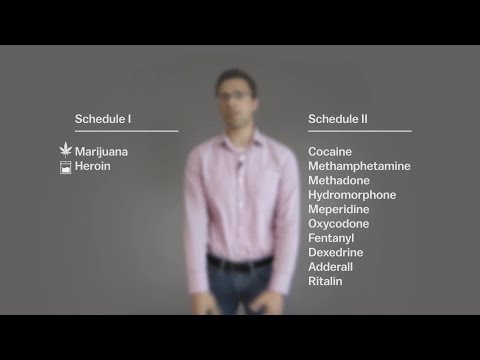

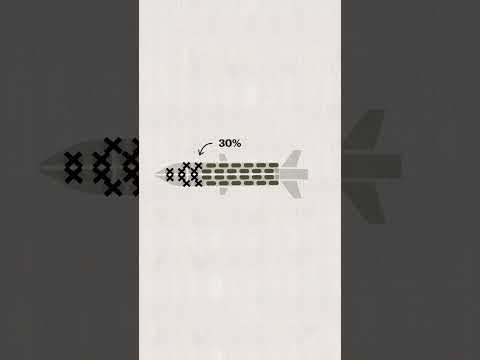

There are two kinds of income in the US. We tax wage income at a higher rate than income earned in stocks and bonds. That means people who get their income from capital gains and stock market interest pay fewer taxes than the same income of someone who works for a paycheck.

Episódios (1595)

Séries similares (10)

Explained

Explained