- Original-Veröffentlichung

- Voherige Episode S01E1295 - How Taiwan held off Covid-19, until it didn't

- Episode S01E1296

-

Externe Links

YouTube Beschreibung

-

Letzte Aktualisierung

25 juillet 2023 - 17:33

auf 11 Datenbanken -

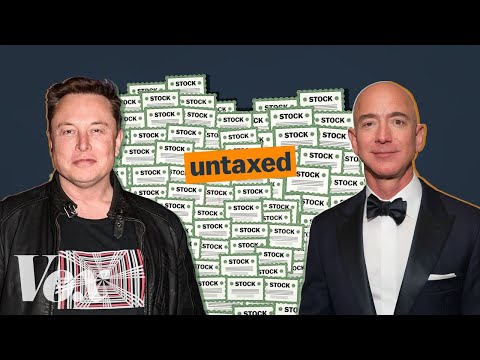

How the rich avoid paying taxes

Capital gains taxes, explained.

Subscribe to our channel! http://goo.gl/0bsAjO

The richest in America don't make money like most Americans. Most people pay income taxes from a regular job. But many in the top 1% make money off their investments, like stocks, and pay capital gains taxes. While normal income has a maximum tax rate of 37%, long-term capital gains tops out at just 20%. Changing that rate, and some loopholes that benefit the wealthiest, is seen as one way to tax the rich.

Read more about how the richest avoid paying income taxes from Vox:

https://www.vox.com/22432338/joe-biden-tax-plan

And an investigation from ProPublica:

https://www.propublica.org/article/the-secret-irs-files-trove-of-never-before-seen-records-reveal-how-the-wealthiest-avoid-income-tax

For more information about Elon Musk's loans:

https://www.wsj.com/articles/elon-musk-techs-cash-poor-billionaire-11588967043

Watch our full video catalog: http://goo.gl/IZONyE

Follow Vox on Facebook: http://goo.gl/U2g06o

Or Twitter: http://goo.gl/XFrZ5H